Explore the Best GA Hard Money Lenders for Real Estate and Investment Financing

The Ultimate Overview to Locating the very best Tough Cash Lenders

Navigating the landscape of difficult cash financing can be a complex endeavor, requiring an extensive understanding of the various aspects that add to a successful borrowing experience. From reviewing lending institutions' credibilities to contrasting rates of interest and charges, each action plays a vital function in securing the ideal terms possible. Moreover, establishing effective communication and providing a well-structured organization strategy can substantially affect your communications with loan providers. As you take into consideration these elements, it becomes evident that the course to identifying the best hard cash loan provider is not as simple as it may appear. What essential understandings could additionally improve your approach?

Understanding Hard Cash Fundings

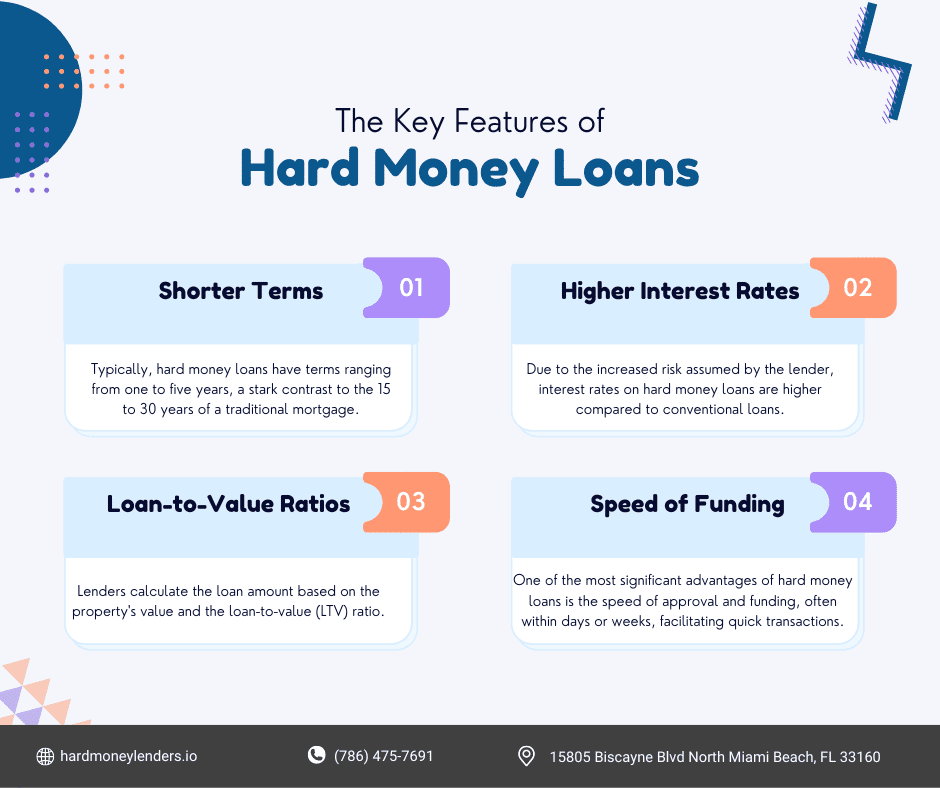

Comprehending difficult cash fundings involves recognizing their one-of-a-kind features and purposes within the property funding landscape. These loans are typically secured by realty and are used by private lenders or financial investment groups, identifying them from conventional mortgage items given by banks or credit rating unions. Tough cash car loans are mostly used for short-term financing demands, typically promoting quick purchases genuine estate investors or designers that require prompt funding for residential property acquisition or remodelling.

One of the defining features of hard cash car loans is their dependence on the value of the residential or commercial property as opposed to the customer's creditworthiness. This allows customers with less-than-perfect credit history or those seeking expedited financing to accessibility capital a lot more conveniently. Furthermore, difficult cash lendings typically include greater rate of interest prices and much shorter repayment terms contrasted to conventional finances, reflecting the raised danger taken by loan providers.

These financings serve different purposes, including financing fix-and-flip jobs, re-financing troubled buildings, or providing capital for time-sensitive chances. As such, recognizing the subtleties of hard money finances is essential for investors that intend to leverage these economic instruments effectively in their property ventures.

Key Factors to Take Into Consideration

When reviewing tough money lending institutions, what essential elements should be focused on to make certain a successful deal? A trusted loan provider ought to have a tested track document of successful offers and pleased customers.

Following, consider the terms of the loan. Various lenders use varying rates of interest, costs, and payment schedules. It is crucial to comprehend these terms completely to avoid any type of undesirable shocks later. In addition, analyze the loan provider's financing rate; a quick approval procedure can be important in competitive markets.

An additional important element is the loan provider's experience in your specific market. A lender familiar with neighborhood problems can give beneficial insights and might be more adaptable in their underwriting procedure.

Exactly How to Assess Lenders

Assessing hard cash lending institutions entails an organized strategy to ensure you pick a partner that straightens with your financial investment goals. A credible lender must have a history of effective deals and a solid network of completely satisfied consumers.

Following, take a look at the lending institution's experience and specialization. Various loan providers might concentrate on various kinds of homes, such as household, business, or fix-and-flip tasks. Select a loan provider whose expertise matches your financial investment strategy, as this understanding can significantly affect the approval procedure and terms.

One more crucial aspect is the lender's responsiveness and communication style. A trustworthy loan provider must be accessible and eager to answer your inquiries comprehensively. Clear communication during the analysis process can suggest just how they will certainly manage your funding throughout its duration.

Finally, useful site ensure that the lender is transparent about their procedures and demands. This consists of a clear understanding of the documentation needed, timelines, and any kind of problems that might apply. Putting in the time to evaluate these elements will encourage you to make an informed choice when picking a hard cash lender.

Comparing Rates Of Interest and Fees

A detailed contrast of passion rates and costs among difficult cash lenders is vital for optimizing your financial investment returns - ga hard money lenders. Hard money car loans typically come with higher rate of interest contrasted to traditional financing, commonly ranging from 7% to 15%. Understanding these prices will certainly assist you analyze the possible costs connected with your financial investment

Along with rates of interest, it is critical to assess the connected costs, which can significantly impact the general loan expense. These costs might include origination fees, underwriting charges, and closing expenses, usually expressed as a percentage of the funding discover this quantity. Origination fees can vary from 1% to 3%, and some lenders might charge added costs for handling or management tasks.

When comparing lending institutions, think about the complete price of borrowing, which encompasses both the rates of interest and fees. This holistic approach will permit you to identify one of the most cost-efficient alternatives. In addition, be certain to ask about any his comment is here type of possible prepayment penalties, as these can influence your capacity to settle the funding early without incurring extra costs. Eventually, a careful evaluation of rates of interest and costs will lead to even more informed loaning decisions.

Tips for Effective Borrowing

Following, prepare a thorough organization plan that describes your project, expected timelines, and financial projections. This demonstrates to lenders that you have a well-balanced technique, improving your reputation. Additionally, maintaining a strong relationship with your lending institution can be advantageous; open interaction cultivates trust fund and can lead to much more favorable terms.

It is also necessary to ensure that your residential property meets the lending institution's standards. Conduct a comprehensive appraisal and supply all needed paperwork to enhance the approval procedure. Last but not least, be conscious of exit strategies to repay the lending, as a clear repayment strategy guarantees lending institutions of your dedication.

Conclusion

Furthermore, tough money lendings usually come with higher passion rates and much shorter payment terms contrasted to conventional finances, reflecting the increased danger taken by lending institutions.

When assessing tough money loan providers, what key aspects should be prioritized to make sure an effective deal?Reviewing hard cash lending institutions entails a systematic strategy to ensure you choose a partner that aligns with your investment goals.A thorough comparison of interest prices and charges amongst hard cash lending institutions is crucial for maximizing your financial investment returns. ga hard money lenders.In summary, situating the best tough cash loan providers demands a thorough evaluation of different elements, consisting of lending institution reputation, car loan terms, and expertise in home kinds